Benefits and problems were income restrictions!High -income layer exclusion is "child -rearing punishment", and child allowance reduction of middle income class accelerates.

1.Child -rearing household benefits and elimination of high -income groups are "child -rearing punishment"

The problem is more income than a coupon or cash

The total married couple is 7 million yen, and the middle income class is also a target of reducing child allowance

In the Diet, the debate on the child -rearing household benefits is exciting, but the issues of coupons or cash are too focused and truly important issues have been forgotten.

The real problem lies in the income limit.

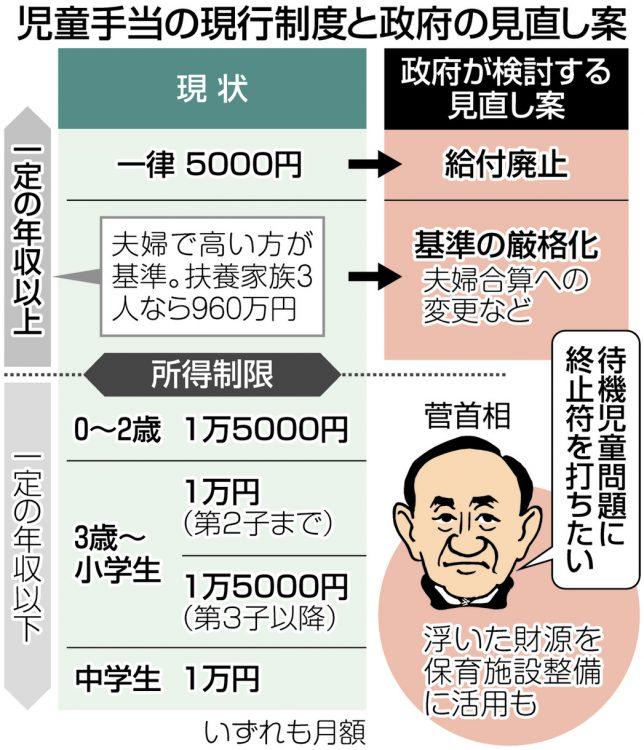

The child -rearing household benefits are excluded from households with an annual income of 9.6 million yen or more.

In the Liberal Democratic Party and the Ministry of Finance, the Restoration, Governor Yoshimura, and the high -income bashing of public opinion, the high -income group that raised children was eliminated.

For local governments, some local governments have discriminated against children living in the same municipality and have decided to eliminate income restrictions.

There are reports that Yokote City, Akita Prefecture, Omitama City, Ibaraki Prefecture, Yoshimi City, Saitama Prefecture, etc. will eliminate income restrictions and provide benefits to household -raising households, but these local governments are an advanced local government who could stop raising children.You will do it.

The equality under the law specified in Article 14, Paragraph 1 of the Constitution is also an issue that makes children think about whether they are not applied.

2.Elimination of child -rearing households that the LDP and Finance are steadily progressing, targets from high -income groups to middle income.

This time, child -raising households with an annual income of 9.6 million yen or more were eliminated.

From the fall of 2022 next year, there will be no child allowance for households with an annual income of 12 million yen or more.

The high -income class bashing has given the Ministry of Finance and the Liberal Democratic Party members a good reason for reducing child allowance.

Income restrictions are reduced by the Cabinet Office (Children's Agency after 2023) without passing the parliament (Article 2 of the Supplementary Provisions of the Child allowance law).

The LDP and the Ministry of Finance have eliminated households with a total annual income of 9.1 million yen or more from child allowances, as well as free high school, and eventually eliminate households with a total of 7 million yen or more from child allowances., I have already pointed out in my book "Child -rearing Punishment" (co -authored with Ritsumeikan University, Keita Sakurai).

The Cabinet Office (Children's Agency) is arbitrated by the pressure of the Ministry of Finance and the Liberal Democratic Party member of the Finance, and it is not strange that the future will be excluded from child benefits, even for a total of 7 million yen households.

The controversy of the elimination of high -income groups with this benefit has raised the risk of activating the debate on reduction of childvices up to the middle income group.

In fact, at the time of the revision of the law in 2021, the child allowance was strictly provided by clearly eliminating high -income households called "qualification loss" instead of "suspension of qualification" once exceeded income restrictions.

If you lose your qualifications, you will not be able to receive child allowances again if you do not apply to the local government yourself, even if your annual income falls and the income is not eligible.

Even if push -type support is realized by the Children's Agency, it may be a system design that will never receive that support once a high -income group.

In particular, the Liberal Democratic Party, the Japan Restoration Association, etc., who was active in eliminating high -income groups to raise children this time, it is necessary to pay attention to future discussions whether child allowance will be actively reduced to the middle income class.

Eliminating the middle and high income group from child allowance is an important matter related to voting behavior of child -rearing households in the Upper House election.

3.There must be no income restrictions on supporting child -rearing households in Japan, which has no nation without the nation, and in Japan, which is super -small.

Japan's decline is accelerated unless it is a country where children are easy to give birth and raise children in all income levels

For super wealthy people who do not need cash benefits such as Toru Hashishita, a "decline" system

High -income group discrimination that university students cannot borrow Japanese student support organizations

In Japan, bashing for high -income child -raising households is too bad.

In the first place, it would be much more important to pursue political responsibilities and improve wages that worsened the low -wage structure, which must be called high income in the first place, which must be called high income.

The high -income groups pay high taxes, pensions and social insurance premiums under the progressive tax system, and are contributing to the development of the next generation of Japanese people in child care.

With too thin support for child -rearing households, the number of income and low -income groups, which are working hard on raising children, contribute to the nation in the sense of the next -generation national development.

There is no nation without the people.

In Japan, which is a very small child, if the child -rearing households are supported regardless of income restrictions, the decline of the nation will only accelerate if they do not create and raise children at any income hierarchy.

橋下徹氏や谷原章介氏、吉村大阪府知事などが、高所得子育て世帯当事者として給付金はいらないと発言されましたが、年収が数千万(もしかして億単位)を超えるような世帯と、都市部で年収1000万円程度でなんとか子育てしている世帯とを同列に論じることもおかしなことです。

いらないとおっしゃる超富裕層のために、児童手当や教育の無償化を含め「辞退」の制度を設ければよいのではないでしょうか。

In this country, if parents exceed 11 million yen annual income, high -income discrimination is occurring that university students cannot borrow Japanese student support organizations.

Even if a young man who is not good at parent and child wants to learn at his own expense, can the parent be discriminated against because of high income?

Of course, securing financial resources needs to be covered by a variety of stable financial resources such as corporate corporations, asset taxation, and child insurance, as pointed out by multiple experts.Isn't the theory of financial resources for politics, especially the ruling party?

In the first place, is the household with an annual income of 90-1,000 million yen a high -income group?

It is concentrated in urban areas such as Tokyo and Kanagawa prefectures, which have high housing expenses and high prices, and many people will never have easy life.

I am worried that the debate that it is strange to get benefits and child allowances is too violent.

If Japan is comparable to one team, can the next generation of teams be maintained if the team's income (taxes, pensions, etc.) contributes and eliminates the people who grow next -generation teams?

The Komeito and other major political parties (other than the Liberal Democratic Party and the Restoration) were particular about the benefits of the whole nation with the child -rearing benefits, and we considered the benefits of the whole nation, how to maintain Japan as a team.I am accepting.

4.To cash benefits for integration, not division

Benefit turmoil divides all people

"Expanding income restrictions" along with the distress support

Child -rearing support is low for low and medium income classes on the premise of universal benefits.

The reason for the benefits to Japan is that this country has failed to integrate the people and all the people have been divided.

So how do you treat cash benefits in politics and administration?

政府による所得再分配の原則は格差の拡大を防ぎ、改善することにあります。

現金給付はまず困窮層支援から議論され設計されるべきです。

その際に住民税非課税世帯かどうかで区分するような「所得制限の崖」を緩和し、住民税非課税世帯の外側で支援が打ち切られ実はとても苦しい世帯に対しても「所得制限のすそ野をひろげる」制度設計も重要でしょう。

The appearance of households that make money even if you earn money due to income restrictions has also been clarified by the Cabinet Secretariat, Regulatory Reform and Administrative Reform Directors' Team Analysis Reports.

* Iso Ryuryu / Ten Tatsuyoshi, 2021, Social benefits in dual -income households, reversal of income in consideration of burden, regulatory reform and administrative reform, direct control report NO.2

Regardless of the high -income and low and medium -income groups, child -rearing households have become more difficult to earn by earnings and pension insurance premiums.

Again, in Japan, which is a very small child, it is essential that child -rearing support is to increase the low and middle income class on the premise of universal benefits to all children.

The low -income and middle -income children's allowances, childbirth expenses, free of charge, and universities are no longer a country where young generations can choose to marry and give birth.

At that time, the amount of support has dropped at a stretch with a total annual income of 7 million, 9.6 million yen, and 12 million yen, etc., and it is not a system that eliminates the willingness to work for child -rearing households, but can respond slowly to the increase or decrease in income.It is necessary to design a system that spreads out Nosuno.

日本では超少子化が国防・経済成長も含め国家安全保障上の課題であることはほとんど理解されていませんが、野田聖子少子化担当大臣もインタビューで強調されているように国家にとっての危機なのです。

* Yasuyuki Nishii and Seiko Noda's "Children's Agency" concept "3 % of GDP for children's policy" (Diamond Online, December 7, 2021)

Japan, which has a strong foreign discrimination and has low wages, is not a country that is easy to choose for foreign immigrants.

Even if technological innovation caused by automation occurs, it is the children and young people who create and maintain that innovation.

This time, it is too late for adults who have been bashing for high -income child -raising layers who regret in Japan 30 years later, 20 years later, 20 years later, 20 years later, where they are not able to secure the immigration labor force and even need the necessary services.

Regardless of whether it is a high -income income, the ability of Japanese adults as well as politicians is questioned whether children can work together to create a country that is easy for children to grow and raise and have no penalty for child care.