Household income of 10 million yen, resident tax for one work and dual -working.Why so expensive?

Household income of 10 million yen, resident tax for one work and dual -working.Why so expensive?

If you work at a company, resident tax will be deducted from your salary, so many people will not know how much they are paid.Resident tax is based on the income of the previous year, and the tax amount is determined by taking into account the income deduction and tax deduction according to individual circumstances.Here, we estimated by a case with a household with an annual income of 10 million yen, and how much to pay the resident tax.Understand how resident tax is determined for your annual income, and apply it to your case.

How do you calculate the resident tax?

Resident tax consists of a "income rate", which determines the amount of tax based on the previous year's income, and a uniform tax.The basic calculation method is as follows.Income percentage = (total income amount -income deduction) x 10 % -tax deduction + per capita rate 5000 yen, Total income.The main income deductions are like Figure 1.

Chart 1

* If the salary income exceeds 11.2 million yen (total income 9 million yen), the deduction amount of the spouse deduction and the special spouse deduction will gradually decrease and disappear.Regarding spouse deduction, up to 380,000 yen for spouse deductions, tax deduction includes mortgage deduction, donation deduction, dividend deduction, etc.

What is the resident tax of a single -working family with an annual income of 10 million yen?

Let's calculate how much the resident tax amount of a single -working family with an annual income of 10 million yen will be.《Conditions》 ・ The head of the household is salary income in the 40s ・ Income is only salary income, monthly salary is 830,000 yen, no bonus deduction, spouse deduction, social insurance premium deduction, and deductions other than dependent deductions.Case 1: Assuming the social insurance premium of the household only for the couple is 1.3 million yen, the resident tax amount can be calculated as follows.{Annual income of 10 million yen -salary income deduction 1.95 million yen- (Basic deduction 430,000 yen + social insurance premium deduction + spouse deduction 330,000 yen)}} x 10 % + per capita percentage 5000 yen = 6004,000 yen ■Case 2: If there is a 19 -year -old child with a couple + 19 -year -old child, a specific dependent deduction of 450,000 yen will be applied.The resident tax amount in this case is as follows.{Annual income of 10 million yen -salary income deduction 1.95 million yen- (Basic deduction 430,000 yen + social insurance deduction deduction + spouse deduction 330,000 yen + specific dependent deduction 450,000 yen)} x 10 % + per capita rate 5000Yen = 559,000 yen Compared to households with no children, the resident tax amount is calculated to be 45,000 yen.The number of children over 16 years old and other dependent relatives, the lower the resident tax.

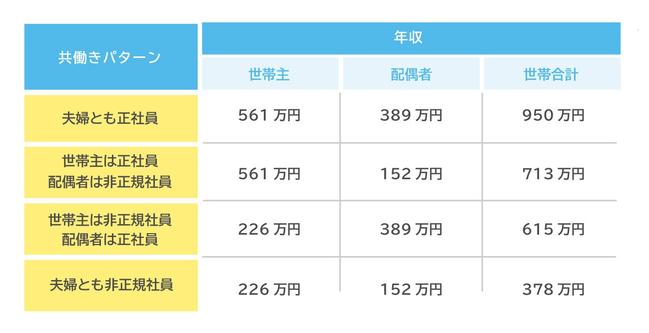

次ページは:世帯年収1000万円の共働き家庭の住民税額は?最終更新:ファイナンシャルフィールド