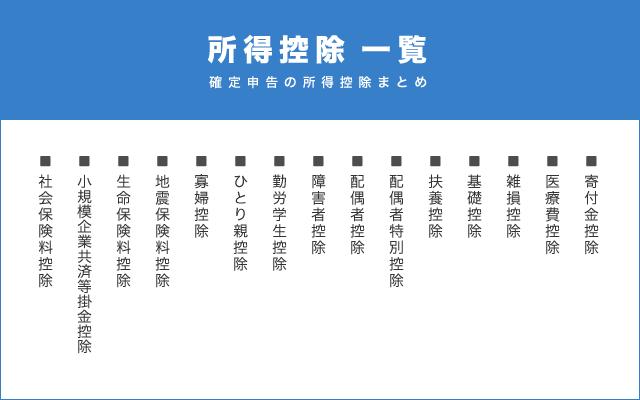

Main income deduction

The types of income deductions and the deduction amount are as follows.

Miscellaneous loss deduction

When a taxpayer or a spouse who can make a living and his livelihood and other relatives occur in assets

The amount of the following one of the following

- (損失の額-保険金等による補てん額)-(総所得金額等の合計額)×1/10

- 災害関連支出の金額-5万円

Medical expenses deduction

When a taxpayer pays the medical expenses of his spouse or other relatives who can make a living or self -livelihood

(Paid medical expenses -The amount supplemented by insurance money, etc.) - {(5%of the total amount of total income, etc.) or 100,000 yen.

(Note) Limited amount 2 million yen

Please see the link below for medical expenses deduction and self -medication tax system.

Medical expenses deduction / self -medication tax system (special case for medical expenses deduction)

Social insurance premium deduction

When a taxpayer pays a social insurance premium that is borne by a spouse or other relatives who can make a living or a living, or is deducted from the salary of taxpayers.

The amount paid or the amount deducted from the salary

Small business mutual aid deduction

When a taxpayer pays a personal pension subscriber or a dynamic dynamic mutual aid based on a small business mutual aid system or a defined contribution pension law

Amount paid

Life insurance premium deduction

When a taxpayer pays an insurance premium or premium for a nursing care insurance contract, etc., or a personal pension insurance contract, etc.

(Note) The insurance contracts concluded with life insurance companies or non -life insurance companies, etc. after January 1, 2012 will be new general life insurance premiums, nursing care insurance premiums, and new individual pension insurance premiums.The insurance contracts concluded before December 31, 2011 are the former general life insurance premiums and the old personal pension insurance premium.

(Amount requested by the following for general life insurance premiums)+(Amount requested by the following for nursing care insurance premiums)+(Amount requested below for personal annuity insurance premiums) (Note) Maximum amount 70,000 yen

For general life insurance premiums and personal pension insurance premiums, the largest amount of deduction calculated in the following formula A, B, and C is applied.

A: 12,000 yen or less: 32,000 yen or less of the paid insurance premium and 32,000 yen or less: (Total amount of the paid insurance premium) x 1/2 + 6,000 yen 32,000 yen or less, 56,000 yen or less.(Total amount of the insurance premium paid) x 1/4 + 14,000 yen

A. 15,000 yen or less: In the case of 40,000 yen for over 15,000 yen of the paid insurance premium, (total amount of insurance premiums paid) x 1/2+7,500 yen, more than 40,000 yen and 70,000 yen or less:(Total amount of insurance premium paid) x 1/4+17,500 yen ¥ 70,000: 35,000 yen

The deduction amount calculated in the calculation formula + B calculated in the formula of B (limit 28,000 yen)

Earthquake insurance premium deduction

When a taxpayer pays insurance premiums or premiums for earthquakes, such as non -life insurance contracts, etc.

For insurance premiums related to long -term and non -life insurance contracts, etc. concluded by the end of 2006, the previous non -life insurance deduction is applied.

(Note) If one contract is applicable to either earthquake insurance or old long -term or long -term or lame insurance, it will be calculated as one of the applicable one, and one will be advantageous.

(Amount requested for earthquake insurance premiums below) + (Amount requested below for long -term loss insurance premiums) (Note) Maximum amount 25,000 yen

The paid earthquake insurance premium

A. If it is 50,000 yen or less: If the amount of insurance premium paid is over 50,000 yen: 25,000 yen

The old long -term or non -life insurance premium paid

C: 5,000 yen or less: Payment of the insurance premium paid in 5,000 yen or less than 15,000 yen: Paid insurance premiums x 1/2 + 2,500 yen Over 15,000 yen: 10,000 yen

One parent deduction (from the 3rd year)

A single parent deduction has been established since the 3rd year (two years for the war).

The only parent deduction can be applied from the 3rd year of Oruwa (income in two years).For the second year of the second year, please refer to the following widow deduction (until the second year of the second year) or the widow deduction (until the second year of the second year).

Regardless of the marriage calendar or gender, those who are not actually married have a child who can make a living (total income amount or less, etc.), and the total income amount is 5 million yen or less.in the case of

Current status of December 31 of the previous year

300,000 yen

Deduction of widow (from 3rd year)

With the founding of a single parent deduction, a widow deduction is a person who does not support a child who can make a living (income of 480,000 yen or less), has a dependent relative other than a child, or bereaves to a husband (if it is unknown.(Including) is a deduction that can be received.

If you are dependent on a child who can make a living, please see the above -mentioned parent deduction.

Please refer to the following widow deduction (until the 2nd year of the Second FY200) for the second year of the second year.

Among those who have not been married to their husband or have been married after divorce, or those who are not clarified by their husband's life and death, they have dependent relatives (total income amount or less, etc.), and their total income is 5 million.In the case of a yen or less

Current status of December 31 of the previous year(注意)条件に該当する親族が前年中にすでに死亡している場合は、その死亡時の現況

260,000 yen

Deduction of widow (until the 2nd year of Oruwa)

Current status of December 31 of the previous year(注意)条件に該当する親族が前年中にすでに死亡している場合は、その死亡時の現況

260,000 yen

特別寡婦(左記の者のうち、扶養親族である子を有し、自己の合計所得金額が500万円以下)のときは300,000 yen

Current status of December 31 of the previous year

260,000 yen

Deduction of width (until 2nd year of Oruwa)

From the 3rd year (two years for the war), a single parent deduction will be applied to those who were subject to the width deduction.Please note that the deduction amount is different.

Among those who are not married to their wife, or who are not married after divorce, or those who are not clarified by the life and death of the wife, have a child who can make a living (the total income amount, etc. is less than 380,000 yen), and the total income of himself.If the amount is 5 million yen or less

Current status of December 31 of the previous year(注意)条件に該当する親族が前年中にすでに死亡している場合は、その死亡時の現況

260,000 yen

Working student deduction

Among those who are working students and have salary income by their own work, the total income amount is less than 750,000 yen and the income (dividend income, etc.) that does not depend on their work is 100,000 yen or less.

Current status of December 31 of the previous year

260,000 yen

Deduction for persons with disabilities

If you have a disabled person or a spouse to be deducted or a dependent relative

Current status of December 31 of the previous year(注意)前年中にすでに死亡している場合は、その死亡時の現況

障害者一人につき260,000 yen

特別障害者(障害者のうち精神又は身体に重度の障害がある者:身体障害者手帳が1級又は2級等)のときは300,000 yen

530,000 yen (cautionary person with special disabilities living together) Special disabled people living together is a spouse or dependent relative who is a deduction, and the other relatives who make themselves or spouses or themselves and livelihood.Those who are regularly living together

Spouse deduction

If the total income amount of a spouse that can make a living is 480,000 yen or less (when the total income of yourself exceeds 10 million yen, or the spouse falls under other dependent relatives and business professionals.It will not apply time.)

Current status of December 31 of the previous year(注意)対象となる配偶者が前年中にすでに死亡している場合は、その死亡時の現況

List of deductions

| 納税義務者本人の合計所得金額 | 控除対象配偶者 | 老人控除対象配偶者(70歳以上) |

|---|---|---|

| 900万円以下 | 330,000 yen | 38万円 |

| More than 9 million yen9.5 million yen or less | 22万円 | 260,000 yen |

| More than 9.5 million yen10 million yen or less | 11万円 | 13万円 |

| 1,000万円超 | 0円 | 0円 |

(Note) A spouse subject to deduction for the elderly was a person born before January 1, 1952 (a person over 70 years old)

Spouse special deduction

If you have a spouse that does not fall under the deduction spouse (when your total income exceeds 10 million yen, or when your spouse is a dependent relative or business of other peopleWill not be applied.)

Current status of December 31 of the previous year(注意)対象となる配偶者が前年中にすでに死亡している場合は、その死亡時の現況

| 配偶者の合計所得金額 | 納税義務者本人の合計所得金額 | ||

|---|---|---|---|

| 900万円以下 | More than 9 million yen 9.5 million yen or less | More than 9.5 million yen 10 million yen or less | |

| 48万円超100万円以下 | 330,000 yen | 22万円 | 11万円 |

| 100万円超105万円以下 | 31万円 | 21万円 | 11万円 |

| 105万円超110万円以下 | 260,000 yen | 18万円 | 9万円 |

| 110万円超115万円以下 | 21万円 | 14万円 | 7万円 |

| 115万円超120万円以下 | 16万円 | 11万円 | 6万円 |

| 120万円超125万円以下 | 11万円 | 8万円 | 4万円 |

| 125万円超1300,000 yen以下 | 6万円 | 4万円 | 2万円 |

| 1300,000 yen超1330,000 yen以下 | 3万円 | 2万円 | 1万円 |

| 1330,000 yen超 | 0円 | 0円 | 0円 |

| 配偶者の合計所得金額 | 納税義務者本人の合計所得金額 | ||

|---|---|---|---|

| 900万円以下 | More than 9 million yen 9.5 million yen or less | More than 9.5 million yen 10 million yen or less | |

| 38万円超90万円以下 | 330,000 yen | 22万円 | 11万円 |

| 90万円超95万円以下 | 31万円 | 21万円 | 11万円 |

| 95万円超100万円以下 | 260,000 yen | 18万円 | 9万円 |

| 100万円超105万円以下 | 21万円 | 14万円 | 7万円 |

| 105万円超110万円以下 | 16万円 | 11万円 | 6万円 |

| 110万円超115万円以下 | 11万円 | 8万円 | 4万円 |

| 115万円超120万円以下 | 6万円 | 4万円 | 2万円 |

| 120万円超123万円以下 | 3万円 | 2万円 | 1万円 |

| 123万円超 | 0円 | 0円 | 0円 |

Dependent deduction

If the total income amount of dependent relatives to make a living is 480,000 yen or less (it will not be applied if the dependent relatives are a business full -time).

Current status of December 31 of the previous year(注意)対象となる親族が前年中にすでに死亡している場合は、その死亡時の現況

| 一人につき | 控除額 |

|---|---|

| 一般扶養親族 | 330,000 yen |

| 特定扶養親族 | 45万円 |

| (老人扶養親族)同居老親等以外 | 38万円 |

| (老人扶養親族)同居老親等 | 45万円 |

| 16歳未満の扶養親族 | 対象外 |

Basic deduction

| 所得金額 | 控除額 |

|---|---|

| 2,400万円以下 | 43万円 |

| 2,400万円超 2,450万円以下 | 29万円 |

| 2,450万円超 2,500万円以下 | 15万円 |

| 2,500万円超 | 0円 |

330,000 yen